Insurance policy protection is one of those things which we often ignore right up until we really need it. It truly is the security Web which can capture us when lifetime throws us a curveball. No matter if it's a sudden clinical crisis, an automobile accident, or damage to your house, insurance defense makes sure that you're not remaining stranded. But, just what does it necessarily mean to own insurance defense? And the way do you know if you are genuinely included? Let us dive into the world of insurance coverage and investigate its many sides to assist you to realize why it is so vital.

What Does Insurance Quotes Mean?

1st, Permit’s talk about what insurance policies security truly is. It’s effectively a contract concerning you and an insurance provider that guarantees economical aid inside the event of a decline, problems, or damage. In Trade to get a every month or annual top quality, the insurer agrees to go over specific pitfalls that you might face. This defense will give you relief, knowing that If your worst occurs, you gained’t bear the whole money load by yourself.

1st, Permit’s talk about what insurance policies security truly is. It’s effectively a contract concerning you and an insurance provider that guarantees economical aid inside the event of a decline, problems, or damage. In Trade to get a every month or annual top quality, the insurer agrees to go over specific pitfalls that you might face. This defense will give you relief, knowing that If your worst occurs, you gained’t bear the whole money load by yourself.Now, you may be thinking, "I’m healthier, I travel diligently, and my residence is in great shape. Do I actually need insurance policy defense?" The reality is, we could under no circumstances forecast the future. Incidents come about, sickness strikes, and purely natural disasters happen devoid of warning. Insurance plan protection acts being a safeguard towards these unforeseen situations, encouraging you handle fees when points go Erroneous. It’s an investment in the long run properly-staying.

One of the more common types of coverage defense is health and fitness coverage. It addresses professional medical fees, from routine checkups to emergency surgical procedures. Without well being insurance, even a short healthcare facility stay could leave you with crippling clinical expenses. Health and fitness insurance policy helps you to accessibility the care you need with no worrying with regards to the economical pressure. It’s a lifeline in moments of vulnerability.

Then, there’s auto insurance plan, which is yet another critical variety of protection. Regardless of whether you're driving a brand-new car or an more mature product, mishaps can come about at any time. With automobile insurance plan, you are coated within the celebration of the crash, theft, or damage to your vehicle. In addition, if you are involved with a collision where you're at fault, your plan can assist protect the costs for the other celebration’s car repairs and health care expenditures. In a means, vehicle insurance plan is sort of a defend defending you from the implications in the unpredictable road.

Homeowners’ insurance plan is an additional critical kind of protection, especially if you individual your own personal house. This protection shields your home from a variety of risks, which include fire, theft, or purely natural disasters like floods or earthquakes. With no it, you could face money damage if your private home had been to generally be wrecked or seriously destroyed. Homeowners’ coverage not only handles repairs, and also delivers legal responsibility security if anyone is hurt on your home. It truly is an extensive protection net for your property and almost everything in it.

Everyday living insurance is 1 location That usually gets forgotten, but it surely’s just as significant. While it’s not something we want to consider, daily life insurance coverage makes certain that your family and friends are financially safeguarded if one thing ended up to happen for you. It offers a payout to your beneficiaries, serving to them include funeral expenses, debts, or living expenses. Lifetime coverage is usually a strategy for exhibiting your loved ones that you just treatment, even Once you're gone.

Another type of insurance coverage safety that’s turning out to be ever more preferred is renters’ insurance plan. For those who lease your private home or condominium, your landlord’s insurance policies may well go over the constructing alone, but it really received’t go over your individual belongings. Renters’ insurance policies is fairly reasonably priced and may safeguard your possessions in case of theft, hearth, or other sudden activities. It’s a small expense that can help you save from big economic reduction.

Even though we’re on the topic of insurance coverage, Permit’s not ignore disability insurance coverage. It’s on the list of lesser-identified forms of protection, but it surely’s extremely vital. Incapacity insurance policies presents income substitution in the event you turn into unable to operate resulting from illness or injuries. It makes sure that you don’t get rid of your livelihood if something surprising comes about, permitting you to give attention to recovery devoid of stressing regarding your finances. For many who rely on their paycheck to produce finishes fulfill, incapacity insurance coverage can be a lifesaver.

Now, let’s discuss the value of selecting the correct insurance supplier. With lots of options on the market, it might be mind-boggling to select the correct a single for yourself. When choosing an insurance company, you would like to be sure they offer the coverage you would like at a price it is possible to afford to pay for. It’s also crucial to take into account their track record, customer service, and the benefit of filing statements. In the end, you'd like View it here an insurance company that could have your again whenever you want it most.

But just obtaining insurance policy security isn’t more than enough. You furthermore may have to have to understand the conditions of your plan. Reading the high-quality print might not be exciting, however it’s critical to understand just what’s included and what isn’t. Ensure you have an understanding of the deductibles, exclusions, and boundaries of your respective coverage. By doing Full info this, you could keep away from awful surprises when you have to file Insurance Policy Solutions a claim. Expertise is electric power With regards to insurance policies.

Getting My Insurance Solutions Provider To Work

An additional element to take into consideration will be the prospective for bundling your insurance plan guidelines. Numerous coverage businesses provide special discounts if you buy various different types of insurance plan by means of them, like household and automobile coverage. Bundling can help you save income although ensuring that you have in depth safety set up. So, in case you’re now looking for just one sort of insurance plan, it would be worthy of Checking out your choices for bundling.The idea of insurance coverage protection goes beyond personalized guidelines as well. Enterprises require insurance far too. Should you very own a company, you very likely deal with pitfalls which will impression your company’s financial wellbeing. Business enterprise coverage protects you from An array of troubles, together with assets destruction, legal liabilities, and personnel-similar risks. For instance, normal legal responsibility insurance will help defend your organization if a client is injured on your own premises. Getting company insurance policy provides you with the security to operate your organization without the need of continuously worrying about what may possibly go Erroneous.

Indicators on Professional Insurance Solutions You Need To Know

As important as it truly is to have the best insurance coverage coverage, It truly is equally essential to review your policies regularly. Life modifications, and so do your coverage wants. In case you’ve lately had a little one, acquired a dwelling, or changed Employment, your present guidelines may well now not be suitable. By examining your coverage protection per year, you make sure that you’re normally adequately lined for your existing instances. It’s a proactive stage to shield your future.

Talking of foreseeable future, insurance policies security can also be part of one's extended-phrase monetary tactic. When it’s principally about masking hazards, specified kinds of insurance coverage, like everyday living insurance, might also serve as an investment. As an illustration, some lifestyle insurance coverage policies Have got a hard cash value ingredient that grows with time. Consequently As well as supplying security on your family members, these guidelines can also work as a discounts automobile to your future.

The underside line is that insurance policies security is a lot more than simply a fiscal protection Web – it’s relief. It’s recognizing that, whatever takes place, you've got a cushion to drop back on. No matter if it’s well being insurance, auto coverage, or residence insurance policies, these procedures make sure that you’re not dealing with lifestyle’s difficulties by yourself. With the ideal insurance safety set up, you could center on residing your life on the fullest, being aware of which you’re lined when the surprising transpires.

Eventually, don’t fail to remember the importance of keeping knowledgeable with regards to the evolving globe of insurance policy. As new challenges emerge and polices change, your insurance policy demands could change. Trying to keep on your own educated on the most up-to-date trends and updates will assist you to make the very best options for your individual or enterprise safety. After all, when it comes to coverage, know-how truly is electricity. So, take some time To judge your options and you should definitely’re receiving the security you may need. Your future self will thanks!

Luke Perry Then & Now!

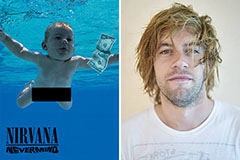

Luke Perry Then & Now! Spencer Elden Then & Now!

Spencer Elden Then & Now! Tony Danza Then & Now!

Tony Danza Then & Now! Ariana Richards Then & Now!

Ariana Richards Then & Now! Monica Lewinsky Then & Now!

Monica Lewinsky Then & Now!